Regressive Taxation:

The U.S. income tax system is actually regressive in several ways, because earned labor income:

- is taxed 15.3% (i.e. [2 x 6.2% = 12.4% for Social Security] + [2 x 1.45% = 2.9% and Medicare]);

- is also taxed 10%-to-37% for federal income taxes (see tables below);

- _________________________________________________________________________________

- for a total of 25.3% to 52.3% (for only Social Securuity, Medicare, and federal income taxes)

Income caps also make the

taxes more regressive (i.e. no Social Security tax on earned income

above a specified amount; e.g. $137,700 for year 2020).

- serve to reduce the percentage of income paid to taxes for those with a larger income,

- and increase the percentage of income paid to taxes for those with less income.

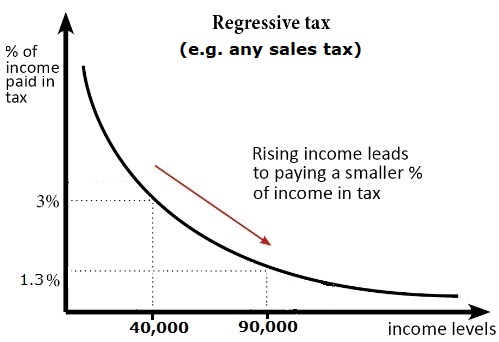

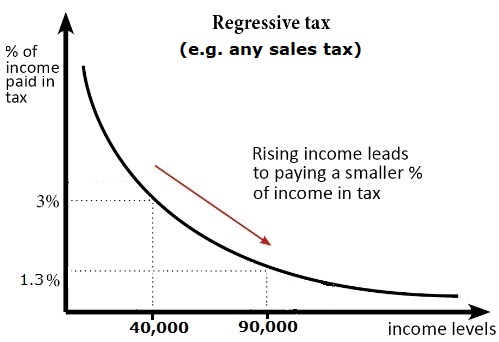

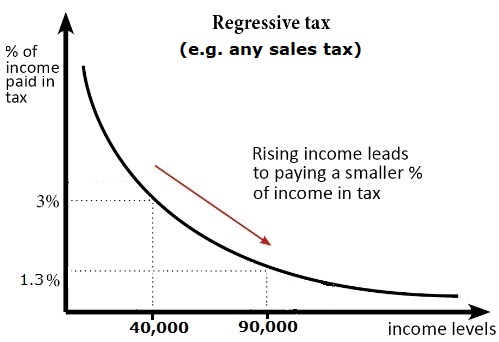

Sales taxes are ALWAYS regressive taxes, which always hit the people of lesser income hardest.

For example, if you buy a car for $20,000 and the sales tax is 6%:

(a) and your annual income is

$40,000, the 6% tax of $1,200 is 3.00% of your annual income (i.e.

100 x (0.06 x $20,000)/$40,000 = 3.00%)

(b)

and your annual income is $90,000, the 6% tax of $1,200 is 1.33% of

your annual income (i.e. 100 x (0.06 x $20,000)/$90,000 = 1.33%)

Therefore, a national

FLAT sales tax (such as the system laughably called the FAIRTAX proposed and promoted by many

Republicans) would also be a regressive tax, because ALL sales taxes

are regressive.

Different Types of Income are taxed at different rates:

Also, capital gains income is not subject to Social Security and Medicare1 taxes (unless investment income exceeds $200K for single, $250K for married).

Apparenty, some types of income are superior to others.

This is how Mitt Romney paid 15% on $42 Million in year 2012.

Yet, IF you make $80K per year in ordinary income, you paid 35.3% on

your income for Social Security, Medicare, and federal income taxes.

However, IF you make $425K per year in capital gains,

you paid 15% on most of that income for only federal income taxes, and

social security taxes only on a portion of that income (i.e. not taxed

social security taxes on income above the cap of $137,700, which is

$8,537 as of year 2020).

Is that fair?

Ordinary Income Tax Rates (Social Security cap in 2020 = $137,700):

- 2017 ____ 2019-to-2025___single____________married

- 10% _____ 10%________ $0-$9,525 _________$0-$19,050

- 15% _____ 12%________ $9,525-$38,700_____$19,050-$77,400

- 25% _____ 22%________ $38,700-$82,500____$77,400-$165,000

- 28% _____ 24%________ $82,500-$157,500___$165,000-$315,000

- 33% _____ 32%________ $157,500-$200,000__$315,000-$400,000

- 33%-35% _ 35%________ $200,000-$500,000__$400,000-$600,000

- 39.6% ____ 37%________ $500,000+ _________$600,000+

Capital Gains Tax Rates (2019-to-2025) for Single:

- Ordinary______________Long-Term

Income_______________Capital Gains

Levels________________Tax Rate

- $0-to-$38,600_________ 0.0%

- $38,601-to-$425,800___ 15.0%

- 425,801 or more_______ 20.00

Capital Gains Tax Rates (2019-to-2025) for married, filing separately:

- Ordinary______________Long-Term

Income_______________Capital Gains

Levels________________Tax Rate

- $0-to-$38,600_________ 0.0%

- $38,601-to-$239,500___ 15.0%

- 239,501 or more_______ 20.00%

Capital Gains Tax Rates (2019-to-2025) for married, filing jointly:

- Ordinary______________Long-Term

Income_______________Capital Gains

Levels________________Tax Rate

- $0-to-$77,200_________0.0%

- $77,201-to-$479,000___15.0%

- 479,001 or more_______20.00%

Capital Gains Tax Rates (2019-to-2025) for head-of-household:

- Ordinary______________Long-Term

Income_______________Capital Gains

Levels________________Tax Rate

- $0-to-$51,700_________0.0%

- $51,701-to-$452,400___15.0%

- 452,401 or more_______20.00%

1NOTE: There is a 3.8% tax only on investment income above $200K for single, or $250K for married;